- AI tool uses smartphone photos to detect hidden damage insurers may charge for later.

- System makes it easier for insurance companies to assess vehicle damage quickly.

- Vehicle auctions and transportation firms could also benefit from this new technology.

Recent AI-powered car scanners introduced by rental car giant Hertz have caused a lot of controversy, leading some renters to be hit with expensive repair bills for minor damage almost imperceptible to the human eye. Unfortunately, things may be about to get even worse as an Israeli startup is now offering a similar damage detection tool to insurers and dealers across the United States.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“0f7e3106-c4d6-4db4-8135-c508879a76f8”);

} else {

adpushup.triggerAd(“82503191-e1d1-435a-874f-9c78a2a54a2f”);

}

});

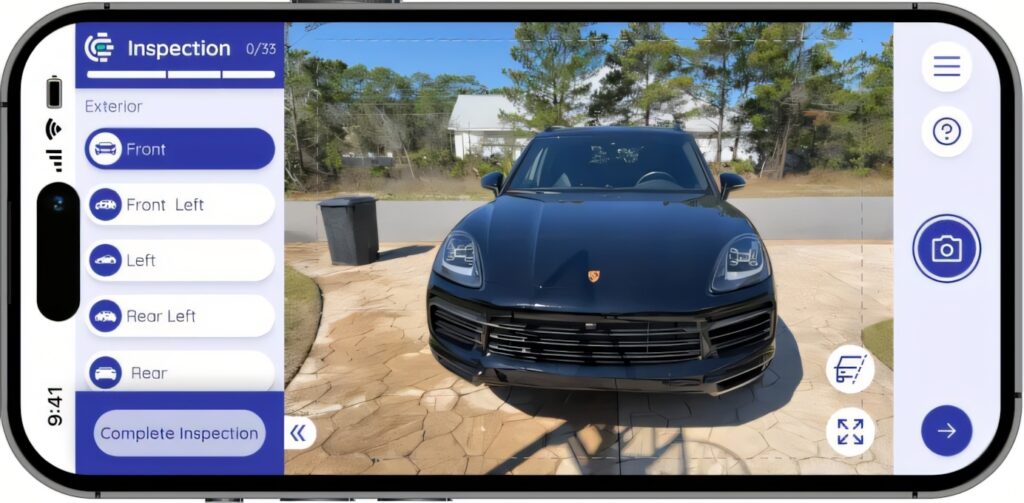

The tool, developed by Click-Ins over a period of more than seven years, works differently from the tunnel filled with high-definition cameras that Hertz vehicles must drive through. Instead, it uses AI and a proprietary system to detect tiny areas of damage in photos captured by a smartphone.

Smartphone-Based Damage Detection

For insurers, the system works as follows. Insurance companies send a web link to customers, prompting them to take eight photos of their car to capture a 360-degree view of it. From there, the AI can detect damage that could usually slip past without detection. It does this by removing reflections and dirt from the photos, providing a completely clear image of the car.

Read: Hertz’s AI Found A Dent You Can’t Even See And Charged Hundreds To Fix It

Insurers can use this technology to establish a visual record of a car’s condition before a policy begins. In the event of a claim, the system could then compare those baseline photos to newer images showing any damage, essentially automating what is typically a manual and time-consuming process. The promise for insurers is lower overhead and faster claims handling.

Fewer Adjusters, Faster Claims

“Say you’re going through a drive-through at Starbucks and you scratch the side of your car on a pole all the way down the side,” Click-Ins chief executive Josh Parsons told Pymnts. “That’s a claim that an adjuster should never have to come out and look at.”

In other words, the system can handle minor claims without requiring human involvement, streamlining the process for both insurers and policyholders.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“bb7964e9-07de-4b06-a83e-ead35079d53c”);

} else {

adpushup.triggerAd(“9b1169d9-7a89-4971-a77f-1397f7588751”);

}

});

Expanding Beyond Insurance

The technology also has potential applications outside the insurance world. Automotive auction houses could use it to document vehicle condition more efficiently, reducing the need for physical inspections. Car transport services may employ the same tool to record a vehicle’s state before and after transit. Even traditional dealerships could adopt it to simplify condition assessments during trade-ins or sales.

Nevertheless, as AI continues to reshape how vehicles are evaluated, these tools are likely to raise questions not just about efficiency, but about fairness, and where to draw the line between helpful automation and overreach.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“bb7964e9-07de-4b06-a83e-ead35079d53c”);

} else {

adpushup.triggerAd(“9b1169d9-7a89-4971-a77f-1397f7588751”);

}

});

#Insurance #Claim #Denied #Photo

More Stories

The Mask Comes Off On Mercedes’ Most Dramatic Electric SUV Yet

Drivers Could See Twice As Much In The ‘90s Than They Can In Some SUVs Today

Chevy’s Halo Car Is Getting Slaughtered On The Used Market